Non-deal roadshows (NDRs) allow institutional investors to get a look under the hood of companies, offering an in-depth understanding of a firm’s narrative that cannot be achieved through press releases, conference presentations, or other publicly available disclosures.

Last week, Stifel’s Brad Reback, a 5-star analyst rated in the top 3% of the Street’s stock pros, attended such happenings with members of Microsoft’s (NADAQ:MSFT) Investor Relations (IR) Team and came away impressed with how things are shaping up for the tech giant.

“The meetings served to reinforce our belief that this is the first time in over two decades MSFT is not playing from behind in an emerging tech trend,” Reback said. “In fact, we believe its increasing GenAI scale will become a meaningful competitive advantage as the company is able to leverage the virtuous circle generated by its unique Infrastructure & Application usage-based insights to inform its future investment and monetization strategies and further distance itself from the competition.”

As anticipated, investors devoted considerable attention to understanding the present 6% contribution of AI revenue. According to Reback’s calculations, this amounts to around $800 million in revenue, marking an increase from the $400 million generated in the September quarter. The company noted that this AI revenue predominantly stems from inferencing rather than training workloads. Additionally, Microsoft emphasized that, due to its unique collaborative R&D partnership with OpenAI, none of ChatGPT’s fundamental GPU training usage is reflected in Azure.

Apart from the direct revenue contribution from GenAI on Azure, management highlighted that these AI workloads also drive substantial usage of other Azure services, particularly those centered around data, security, and governance.

Looking at Microsoft’s AI IaaS (infrastructure as a service)/PaaS (platform as a service) opportunity, Reback thinks it’s quite feasible these could double Azure’s Total Addressable Market (TAM), noting that it took Azure around 3 full years to reach annual revenue of ~$1.9 billion (FY16), but already by the end of this fiscal year, AI IaaS/PaaS workloads should be on track to reach a ~$7 billion+ run-rate after only six quarters following the “launch.”

As also expected, investor inquiries focused on the adoption, usage patterns, and initial customer satisfaction with the M365 Copilot. The company is highly optimistic about the current state of the product, citing widespread positive feedback from customers, particularly among organizations implementing the solution at “some level of scale.”

“As history shows,” Reback noted, “enterprises typically move with a measured cadence with respect to newer applications, but we continue to believe the pace of uptake will be faster than historical rates for other new solutions given the tremendous operational leverage that customers can gain from the Copilot framework.”

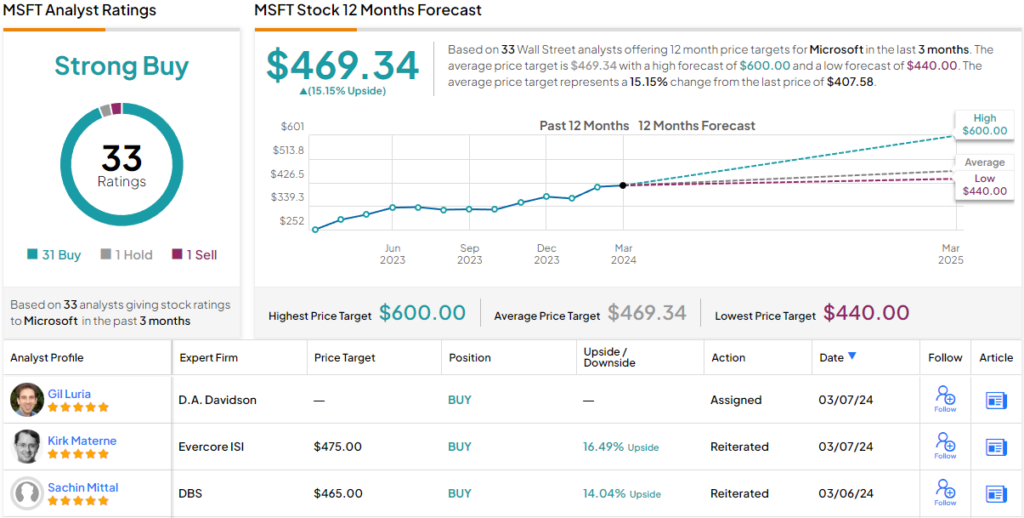

All told, Reback rates MSFT a Buy along with a $455 price target, making room for gains of 9.5% from current levels. (To watch Reback’s track record, click here)

There’s hardly any disagreement with that take amongst Reback’s colleagues. 1 Hold and Sell, each, aside, all 31 other reviews are bullish, making the consensus view here a Strong Buy. At $469.34, the average target suggests shares will surge 15% over the coming months. (See Microsoft stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.