Chinese tech giant Tencent Holdings (OTC:TCEHY) (HK:0700) plans to double its share repurchases to around $12.8 billion after its fourth-quarter top-line growth failed to impress investors.

Tencent’s Q4 revenue increased by 7% year-over-year to $21.9 billion. However, the figure largely missed estimates. Still, the company’s operating profit ticked up by a healthy 35% to $6.9 billion. While its combined Monthly Average Users (MAUs) increased by 0.5% sequentially to 1.34 billion, mobile device MAUs contracted by 0.7% to 554 million.

During the quarter, higher advertising demand for video accounts propelled revenue from Online Advertising 21% higher to RMB 29.8 billion. Concurrently, increased commercial payment activities and an expansion in wealth management services helped revenue from FinTech and Business Services rise by 15% to RMB 54.4 billion.

The company now plans to boost its shareholder returns with higher share repurchases and dividends. It is doubling share buybacks to HKD 100 billion or roughly $12.8 billion for 2024. Moreover, Tencent is hiking its dividend by 42% to HKD 3.40 per share.

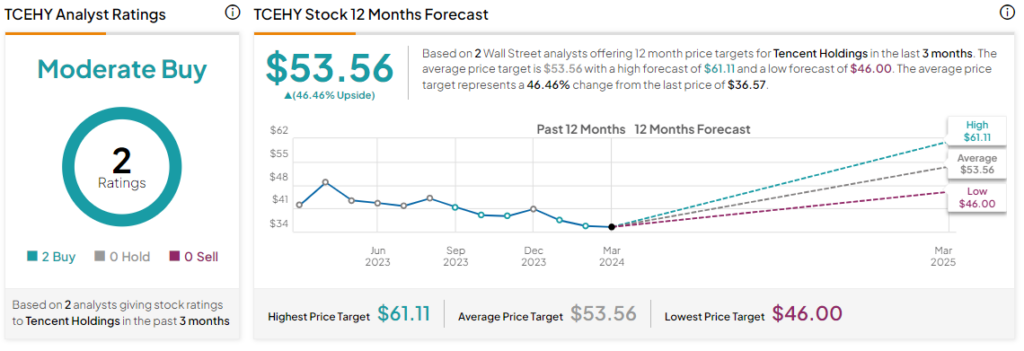

What Is the Price Target for Tencent?

Tencent’s share price has steadily declined by nearly 14% over the past year. Overall, the Street has a Moderate Buy consensus rating on Tencent Holdings alongside an average TCEHY price target of $53.56. While this implies a 46.5% potential upside in Tencent, analysts’ views on the company could see changes following today’s earnings report.

Read full Disclosure