SoFi Technologies (NASDAQ:SOFI) shares followed a familiar path once the neobank dialed in its latest quarterly readout. The company beat expectations on both the top-and-bottom-line, but that hardly seemed to matter to investors, who sent the shares plummeting, as the company’s guidance failed to meet expectations.

In Q1, SOFI generated adj. revenue of $580.65 million, amounting to a 26.2% year-over-year increase while beating the Street’s forecast by $21.12 million. EPS of $0.02 also fared better than the analysts’ expectations, by $0.01.

However, for Q2, the company expects adjusted net revenue in the range of $555 million to $565 million, below the consensus estimate of $590.2 million. SOFI also anticipates adjusted EBITDA of $115 million to $125 million, falling short of Wall Street’s forecast of $135.9 million.

Interestingly, however, at the same time, the company raised its full-year forecast, now expecting adjusted EBITDA to come in between $590 million to $600 million, up from the previous $580 million to $590 million range and above the Street’s call for $585.7 million. Additionally, revenue for the year is now expected to come in between $2.39 billion to $2.43 billion. That is not only an increase on the prior guide of $2.365 billion to $2.405 billion, but also above the consensus estimate of $2.38 billion.

So, it’s clear investors were more concerned with the near-term outlook here. They might also have been wondering, like Wedbush analyst David Chiaverini, whether the 2024 guide is a realistic one.

Considering Chiaverini believes the tech platform’s anticipated revenue growth is a “major component” of the company’s current FY24 guide, and that tech platform revenue is expected to be “seasonally weaker” in Q2, given the “steep implied ramp up” in the second half of the year, Chiaverini thinks it might be difficult for SOFI to meet its target of 20% tech revenue growth this year.

That is just one of several other negatives, which include: “1) loan origination and sales revenue being the lowest reported on a quarterly basis going back several years, 2) SoFi plans to be conservative with lending segment growth despite its recent $600 million of debt-to-equity conversion, and 3) the departure of multiple senior level employees including SoFi’s Chief Risk Officer (took a position at PayPal), and the President of SoFi Bank (new position not disclosed).”

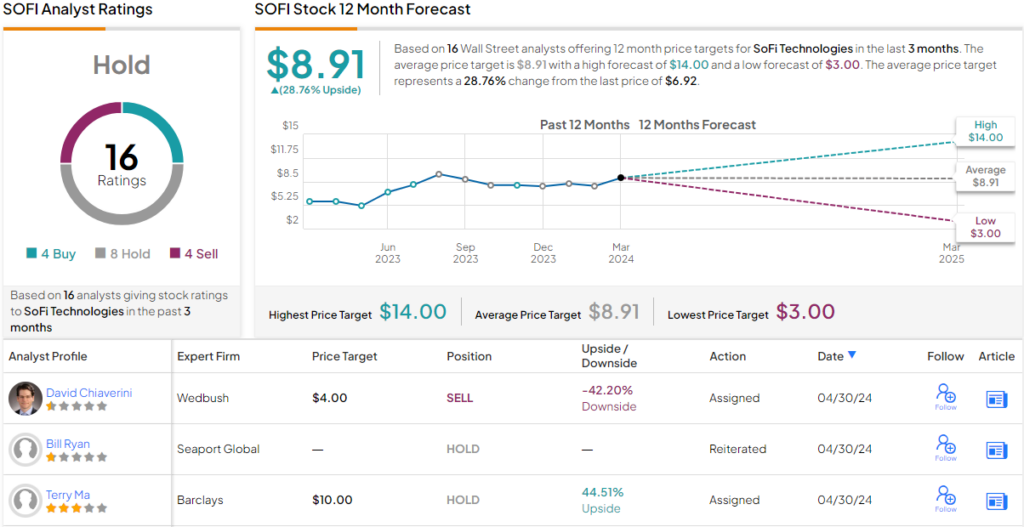

All in all, Chiaverini rates SoFi shares an Underperform (i.e., Sell), along with a Street-low price target of $4. Investors stand to lose 42%, should Chiaverini’s bearish thesis go according to plan in the year ahead. (To watch Chiaverini’s track record, click here)

3 other analysts join Chiaverini in the bear camp with Sell ratings, but with the addition of 8 Holds and 4 Buys, the consensus view is that this stock is a Hold. Nevertheless, there seem to be quite a few analysts that think the shares are undervalued; at $8.91, the average price target factors in one-year growth of ~29%. (See SOFI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.