It’s always a good idea for investors to seek out the strategies used by the market’s investing giants, and you can certainly say Cliff Asness belongs in that elite group.

Asness has a net worth of $2.6 billion, is the co-founder the chief investment officer at AQR Capital Management, a leading quantitative fund boasting $103 billion in assets. He studied under and served as a teaching assistant for Eugene Fama, the Nobel Prize-winning economist from the University of Chicago, dubbed the “father of modern finance.”

Asness advocates diversification, emphasizing the importance of spreading investments across various assets to manage risk effectively. The billionaire also favors value and is a proponent of momentum investing.

Against this backdrop, Asness been throwing his weight behind Nvidia (NASDAQ:NVDA) and (NASDAQ:GOOGL), two heavy hitters in the AI game. And he’s not alone in showing confidence – according to TipRanks’ database, analysts on Wall Street are also gung-ho about these stocks, rating them as Strong Buys. Let’s take a closer look.

Nvidia

You know a company has reached some sort of unique status when at an event the CEO is greeted like a rock star. That was the sort of reception afforded Jensen Huang, the co-founder and CEO of Nvidia, at the company’s recent GTC conference, where Huang made his keynote speech at a packed SAP Center in San Jose.

Considering Nvidia’s huge success over the past year, maybe it’s not all that surprising Huang is now getting the Steve Jobs-like treatment. The past year has seen the semi-giant become the world’s third most valuable company, with a market cap of $2.26 trillion, while the stock just can’t seem to stop piling on the gains.

But the big returns (all 235% of them) have been built on real success rather than mere hype and for a very simple reason. Nvidia is a company operating at the forefront of tech innovation and is the undisputed market leader in AI chips. Simply put, Nvidia makes the best chips that power the data centers behind AI, and everyone wants a piece.

The stock’s ascent has been built on a series of earnings reports that first drew astonishment on Wall Street but have now become almost the norm. The most recent reading, for FQ4 (January quarter), showed revenue increased by a huge 265.3% year-over-year to $22.1 billion, in turn beating the forecast by $1.55 billion. If that seems like a huge gain, just consider the strides made by the main breadwinner, the Data Center segment; here revenue grew by 409% to a record $18.4 billion. The tremendous top-line beat extended to the bottom line, with adj. EPS of $5.16 easily outpacing the consensus estimate by $0.52. Nvidia didn’t disappoint with the outlook either, calling for F1Q revenue of $24.0 billion at the mid-point vs. consensus at $22.03 billion.

With all that on offer, it’s hardly surprising to find Asness has a big stake here. He owns 1,671,007 shares, currently valued at more than $1.5 billion.

The company also has a fan in Truist’s William Stein, an analyst ranked in 13th spot amongst the thousands of Wall Street stock pros, who views Nvidia as “*the* AI company.”

“We see NVDA’s leadership as driven less by the raw performance of its chips, and more by its culture of innovation, ecosystem of incumbency, and massive investment in software, AI models, and services, that we believe makes its chips a default choice for most engineers building AI systems,” the 5-star analyst explained. “We expect NVDA’s superior positioning in gaming, server acceleration/AI and, eventually, autonomous driving, will lead to ongoing structural fundamental growth and stock outperformance.”

To this end, Stein rates NVDA stock a Buy, while his $1,177 price target suggests the shares will climb 30% higher over the coming months. (To watch Stein’s track record, click here)

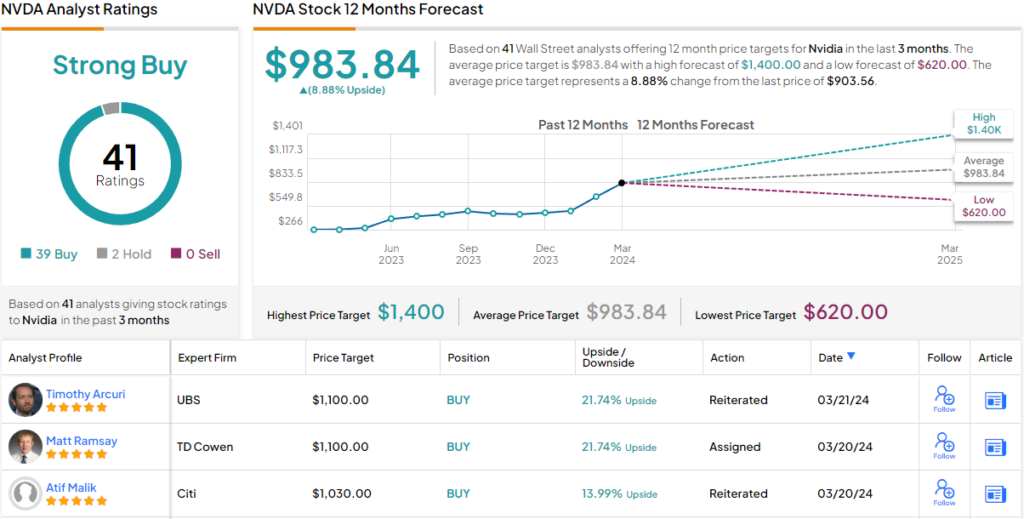

Most on the Street agree with that stance. Based on 39 Buys vs. 2 Holds, NVDA gets a Strong Buy consensus rating. (See Nvidia stock forecast)

Alphabet

Sitting one spot behind Nvidia in the list of the world’s most valuable companies is Alphabet, the parent company of Google. Asness holds a significant stake here as well, with ownership of 4,903,946 shares, which currently command a market value north of $740 million.

Alphabet has its fingers in many pies, from YouTube to the navigation app Waze, the self-driving unit Waymo, and the AI company DeepMind, but its crown jewel remains Google, its flagship search engine and a name synonymous with internet exploration. Google processes billions of queries daily, shaping the online experiences of users worldwide.

Of course, Google also offers an array of services spanning cloud computing, software, hardware, and more, but a look at Alphabet’s most recent quarterly results shows the size of the Search business. The segment generated revenue of $48.02 billion, amounting to a 12.7% year-over-year increase. That accounted for more than half of the total revenue haul, which reached $86.31 billion, for a 13.5% y/y uptick while beating the forecast by $1.04 billion. The company also came good on the bottom line too with EPS of $1.64, beating the Street’s call by $0.04.

However, while the tech giant remains the Search leader, the rise of ChatGPT and GenAI has seen Google playing catch up, and there have been concerns that its own AI tool, Gemini, is not up to the task, having had some well-publicized gaffes.

But that is not a worrying factor for Wedbush analyst Scott Devitt, who thinks the company is well-positioned to make the most out of the opportunity afforded by AI. In fact, based on the strength of its prospects, Devitt recently added Alphabet to the investment firm’s Best Ideas List (BIL).

“We believe the perceived structural risks to Google Search are overstated and continue to view Alphabet as a net beneficiary of generative AI,” the 5-star analyst said. “Alphabet’s competitive advantages are multifaceted, the company has an unmatched breadth of data to develop and train AI models across text, images, and video, a massive user base spanning Google Search, YouTube, Android, and other Google applications, AI-optimized compute infrastructure supported by custom silicon (TPUs), access to leading engineering talent, and a proven track record of effective monetization. We continue to view Alphabet as a secular winner within the digital advertising industry with broad exposure and durable market share of overall media spending.”

These comments form the basis of Devitt’s Outperform (i.e., Buy) rating on GOOGL Stock, while his $175 price target factors in one-year returns of ~16%. (To watch Devitt’s track record, click here)

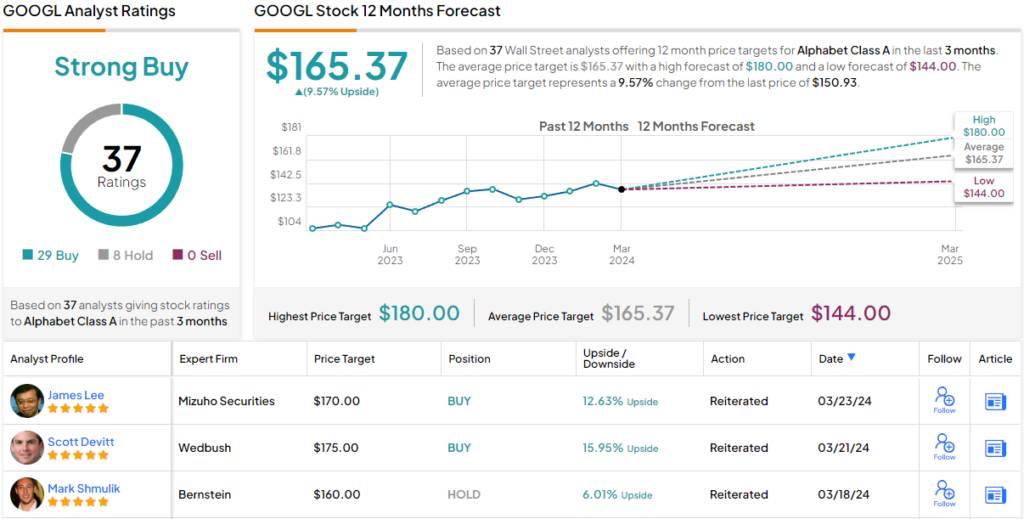

Looking at the rating’s breakdown, based on a mix of 29 Buys and 8 Holds, the analyst consensus rates GOOGL stock a Strong Buy. (See Alphabet stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.