Given MicroStrategy’s (NASDAQ:MSTR) connection to Bitcoin (BTC-USD), it’s almost surprising to hear that they’ve done something that isn’t connected to Bitcoin at all. But that’s what happened earlier today when it rolled out a new tool to improve its presence in analytics. The news was comparatively good to investors’ ears, as they sent shares up fractionally in Tuesday afternoon’s session.

So what did MicroStrategy do that had nothing to do with Bitcoin? It unveiled a new tool known as MicroStrategy Auto, a customizable bot that uses artificial intelligence (AI) in a bid to provide business intelligence depending on a customer’s needs.

It can be used by itself, as part of the MicroStrategy ONE library, or built into other companies’ tools. And that’s just the start, too; MicroStrategy’s chief product officer, Saurabh Abhyankar, revealed that MicroStrategy has “dozens of new features…” in the works.

Insiders Are Taking Profits

A recent post from CEO Michael Saylor noted that MicroStrategy is still “…betting on Bitcoin.” And with Bitcoin recently passing the $70,000 mark once again, it was clear that the bet might have been a good one, assuming it doesn’t suffer another sudden reversal. But one point suggests that not everyone in MicroStrategy is convinced. We recently took a look at MicroStrategy’s insider trading activity and discovered that insiders are cutting bait and taking profits.

Is MSTR a Good Stock to Buy Today?

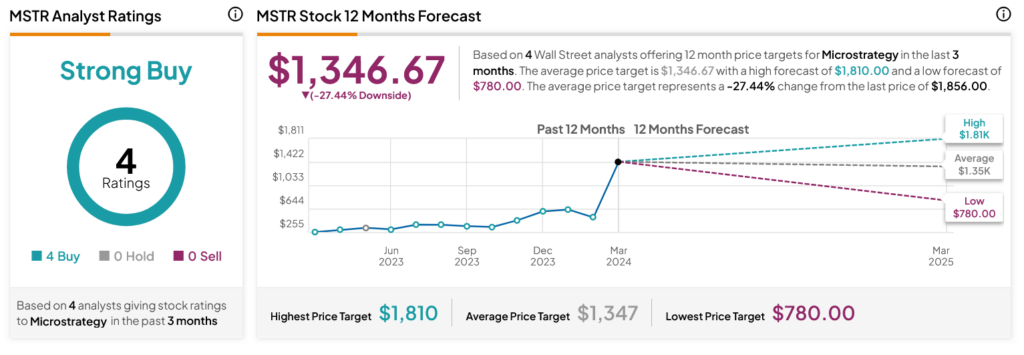

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSTR stock based on four Buys assigned in the past three months, as indicated by the graphic below. After a 671.05% rally in its share price over the past year, the average MSTR price target of $1,347 per share implies 27.44% downside risk.