Investor sentiment about a stock can dramatically swing to the positive or negative based on a catalyst event. Cullinan Therapeutics (NASDAQ:CGEM) enjoyed such a catalyst event when it received a positive analyst report touting the strength of its pipeline in mid-April, and the shares have jumped up over 50% since. The pipeline candidates are all clinical-stage, so it’s still a highly speculative play, but the upside potential is greatly enticing.

Digging Deeper into Cullinan’s Pipeline

Cullinan Therapeutics is a biopharmaceutical company focused on developing a diversified pipeline of targeted oncology and immuno-oncology therapies. In a strategic move, the company has constructed an assortment of clinical-stage assets. These assets directly focus on inhibiting critical factors that induce diseases, and on mobilizing the immune system to eradicate diseased cells. This approach is applicable to both cancer and autoimmune disease.

The treatment candidate furthest along in Phase 2/3 of clinical trials is Zipalertinib (CLN-081), which targets non-small-cell lung cancer. Another promising candidate is lymphoma treatment candidate CLN-978, which has generated some buzz based on a recent publication in Nature Medicine citing positive clinical data for a similar treatment.

Furthermore, the company has a host of other treatment candidates in Phase 1 trials, for which it projects receiving data in the second half of 2024.

Recent Financial Results & Outlook for Cullinan Therapeutics

The company reported a net loss of $155.1 million for 2023, predominantly driven by $148.2 million in R&D expenses.

As of December 31, 2023, the company reported cash, cash equivalents, investments, and interest receivable amounting to $468.3 million. Based on management’s current operating plan, they expect these cash resources to sustain the company well into the second half of 2026.

Also, the company has initiated a private placement deal with institutional investors, aiming to raise about $280 million through the sale of over 14 million shares and pre-funded warrants. The capital raised will facilitate the clinical development of CLN-978 and extend the company’s financial stability until 2028.

What is the Price Target for CGEM Stock?

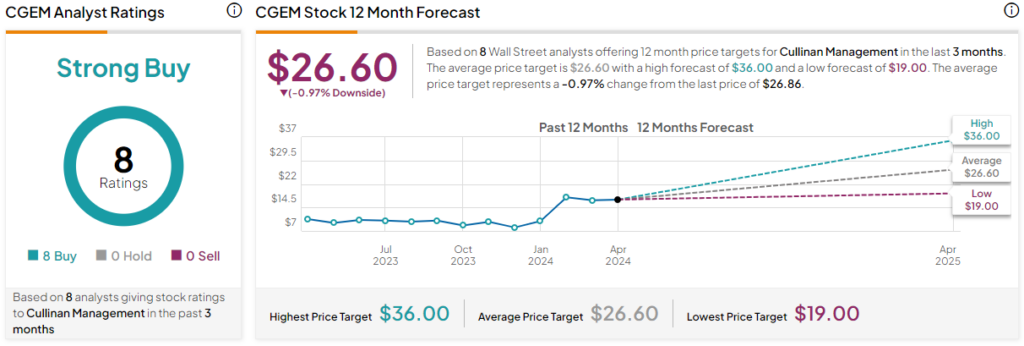

The stock has been trending upward, climbing over 160% in the past year, and trades at the high end of its 52-week price range of $7.64-$29.12. It demonstrates positive price momentum, trading above the 20-day (18.02) and 50-day (16.93) moving averages.

Analysts following the company have been bullish on the stock. For instance, BTIG analyst Kaveri Pohlman recently raised the price target from $20 to $30 while reiterating a Buy rating on the shares, citing the significant upside potential of the treatment pipeline candidates.

Cullinan Therapeutics is rated a Strong Buy based on the recommendations and 12-month price targets eight Wall Street analysts issued in the past three months. The average price target for CGEM stock is $26.60, representing a -1.17% change from current levels.

Closing Thoughts on CGEM Stock

Cullinan Therapeutics has received a lot of positive buzz lately, driving the shares up significantly. Investor sentiment can be fickle, and it may take some time for the company to bring a treatment to market successfully, so there is a likelihood of a pullback from current levels at some point. However, the pipeline looks promising and offers robust potential upside in the long term, marking this stock as one to keep an eye on.