With most of the market giants having now posted their latest quarterly results, the Q1 earnings season reached a climax of sorts. That’s not to say there aren’t more interesting readouts on the way, one of which will take place on Tuesday (May 7).

Before the bell rings, Walt Disney (NYSE:DIS) will release its fiscal second-quarter report and ahead of the print, driven by higher OI estimates, Deutsche Bank analyst Bryan Kraft has made some adjustments to his DIS model.

The analyst reiterated a Buy rating on DIS shares and raised his price target from $125 to $130, suggesting there’s now upside of 10% from current levels. (To watch Kraft’s track record, click here)

“While the stock doesn’t offer tremendous upside unless there is further multiple expansion, we do believe that Disney can maintain its current ~24.5x F2024E P/E and carry it forward to 2025 as the year progresses on the back of strong earnings growth, which is what our PT assumes,” Kraft explained on his new target. “Importantly, we think that the company has regained its stride and the risk of negative earnings revisions for the remainder of the year is relatively low, with positive revisions having a higher probability.”

So, what should investors be looking out for in the report? Orlando visitation rates remains one key focus area. Given lower visits in Orlando, beginning in F3Q23, there was a slowdown in domestic parks revenue growth. Management put the weakness down to comps against the 50th Anniversary Celebration, with Kraft noting the tough comp will end at the conclusion of F2Q24. Given that Comcast is also experiencing some softness in Orlando, Kraft expects investors will be “particularly interested in what Disney saw during April and how bookings/reservations are shaping up for F3Q overall.”

Disney+ subscriber growth and its ARPU outlook will also be under the microscope while an update on the progress of cost cutting initiatives should also be forthcoming (the current guide calls for more than $7.5 billion in cost reductions).

Furthermore, there should be more info on how the Hulu-Disney+ integration is going, with management having implied that so far the integration has been successful, surpassing all of their engagement and viewership metrics. “It will be interesting to hear whether or not there’s been a detectable positive impact on other KPIs; namely ad revenue, churn, and gross adds,” says Kraft on the issue.

Additionally, more details around the potential for a minority stake sale of ESPN will also be welcome.

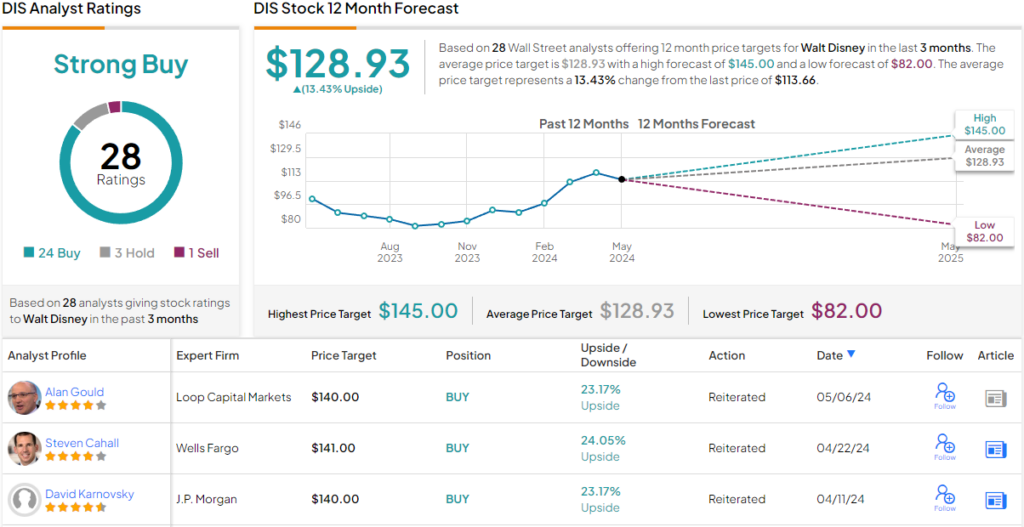

So, that’s the Deutsche Bank view, what does the rest of the Street have in mind for Disney? Based on a mix of 24 Buys, 3 Holds and 1 Sell, the analyst consensus rates the stock a Strong Buy. The average target closely resembles Kraft’s objective; at $128.93, the figure factors in one-year growth of 13.5%. (See Disney stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.