After everything that aircraft maker Boeing (NYSE:BA) has seen lately, it would be forgivable to think that maybe it’s not a hot idea to buy it for a while—at least, not until it gets its various issues worked out. But those who pursue such a conservative strategy will be missing out, says one analyst, who issued a somewhat backhanded encouragement to buy in. It was, meanwhile, good enough for investors, who sent shares up fractionally in Thursday afternoon’s trading.

Citigroup put out the call that this was a good time to “accumulate” Boeing, even as it lowered its 12-month price target from $263 per share to $252. However, Citigroup followed that up by noting there was a “longer-term path” for Boeing shares to reach as high as $330 a share, thanks to improving cash flow and accompanying valuation improvements.

Citigroup’s thesis on this isn’t too surprising: basically, Boeing’s taken several beatings, and share prices are in open decline. So this may be the best time possible to get in, as there’s pretty much nowhere to go from here but up. After all, there are still only two firms that can fill the demand for airliners—Boeing and immediate rival Airbus (OTHEROTC:EADSY)—which is on the rise. Thus, Boeing is, pretty much by default, likely to win.

Further Trouble Ahead

However, the problem is that this situation may not be sustainable. Both China and Japan have been spotted making attempts at aircraft manufacture. The Commercial Aircraft Corporation of China brought out its C919 back in February. Meanwhile, Japan’s Ministry of Economy, Trade and Industry is putting up five trillion yen—about $33 billion—to get an aircraft powered by alternative fuel sources up and running in the next 10 years. And with Boeing’s union seeking a board seat as part of contract concessions, Boeing may have more problems than Citigroup expects.

What Is the Prediction for Boeing Stock?

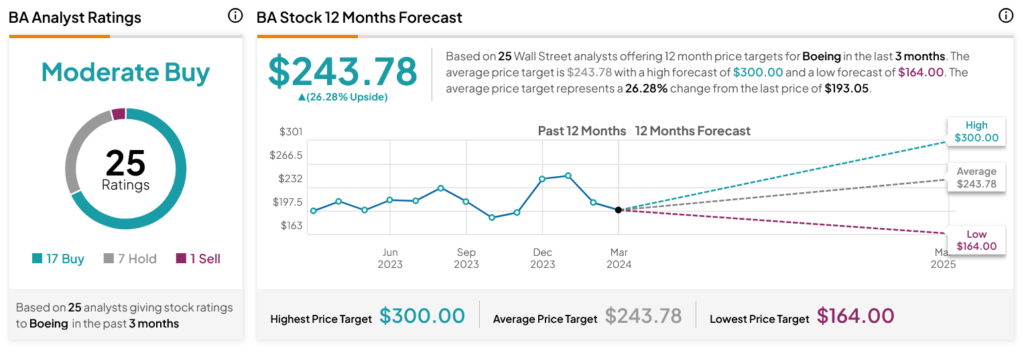

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 17 Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 7.32% loss in its share price over the past year, the average BA price target of $243.78 per share implies 26.28% upside potential.