While Bitcoin (BTC-USD) itself is enjoying a bit of a renaissance right now, up nearly 3% in Thursday afternoon’s trading, the same can’t be said for several spot Bitcoin exchange-traded funds (ETFs). In fact, some of the biggest such funds are seeing a run for the exits as a massive, three-day bloodbath in the sector continues unabated.

Over the course of the last three days, $742 million has left a range of Bitcoin funds, including the Grayscale Bitcoin Trust (NYSEARCA:GBTC). Funds from Fidelity and BlackRock were similarly hit as investors pulled back, or perhaps simply took profit, in the midst of a frenzy that sent Bitcoin up to its all-time high. An attempt to rally in Asia seems to have sputtered out, though the Federal Reserve’s latest decision to maintain interest rates at their current level seems to have offered a little extra help in the field.

Not as Bad as It Seems

While this sounds like a pocket disaster in the making, it’s important to note the size of the inflows that preceded these outflows. That bit of perspective may change a few minds in and of itself. While $742 million left the field from Monday to Wednesday, that same list of 10 funds took in $11.4 billion to date. It’s objectively a huge total, but on a percentage basis, it’s a single-digit percentage, making it not as bad as it seems.

However, Bitcoin’s increasing popularity is certainly drawing attention; just yesterday, a former take-out worker named Jian Wen was found with several Bitcoin wallets valued at a cumulative total of two billion pounds sterling (about $2.53 billion). Wen was tasked with buying jewelry and houses with the cryptocurrency in a bid to launder it.

Is GBTC Stock a Buy?

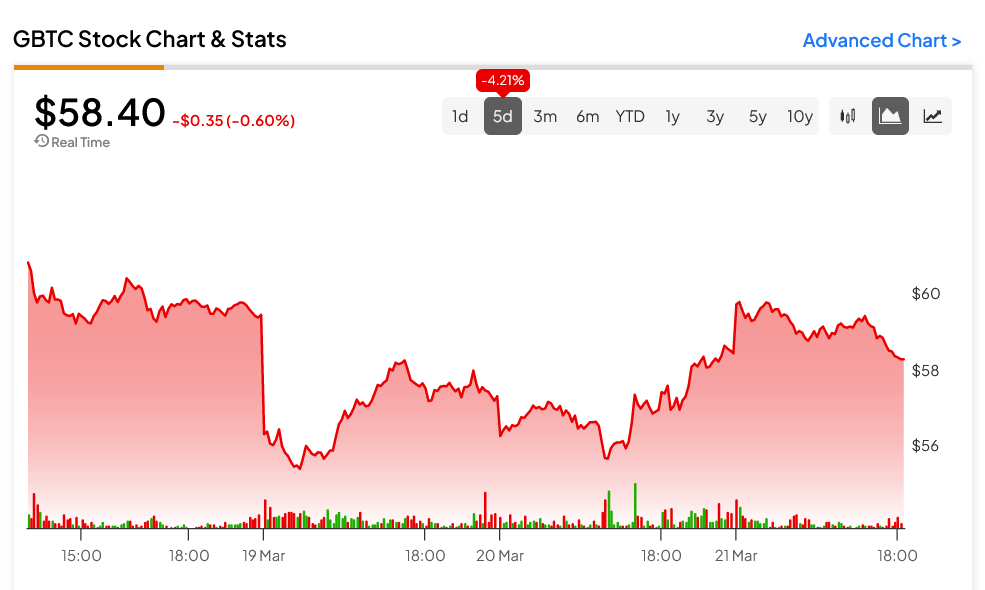

Turning to Wall Street, a look at the last five trading days for the Grayscale Bitcoin Trust ETF shows that it’s somewhat off its peak. It’s actually up 287.86% for the entire year, however, in the last five days, it’s lost about 4.21%. It’s made two attempts to rally to the level it was at five days ago, but the rallies ultimately fizzled.