Federal Realty Investment Trust (NYSE:FRT) stock appears to offer an attractive investment case at its current levels. This Dividend King, boasting a 56-year dividend growth track record, has seen its shares experience pressure from interest rate hikes. Yet, this retail REIT’s quality property portfolio of 102 real estate projects comprising about 26.0 million commercial square feet keeps producing robust results. For this reason, the ongoing share price lag could be offering a decent entry point. Thus, I am bullish on FRT.

Improving Profitability Despite Interest Rate Hikes

Most REITs saw their profitability shrink last year as a result of the interest rate increases that took place in 2022 and 2023. However, some quality names in the sector managed to keep thriving, and Federal Realty was one of them. The company continued to grow its revenues, which, along with cautious cost control, enabled it to post record FFO/share despite the growth in interest expenses. Let’s take a deeper look.

For FY 2023, Federal Realty posted revenues of $1.13 billion, an increase of 9.4% year-over-year. Federal Realty’s revenue growth reflects high tenant demand for its properties, evidenced by its robust leasing activity and occupancy rate.

In particular, the company signed 408 leases for 2.03 million square feet at an average rent of $36.75 per square foot versus the average contractual rent of $33.43 per square foot signed on last year’s leases. This implies a cash-basis rollover growth of 10% on comparable spaces or an increase of 22% on a straight-line basis. In the meantime, the portfolio was 92.2% occupied and 94.2% leased at the end of the year.

Expenses-wise, management exercised cost control, with rental expenses growing by only 1% to $21.7 million. General and administrative expenses even declined by 3.6% to $50.7 million. Therefore, despite interest expenses growing by 22.5% to $167.8 million, the company was able to expand its margins. Thus, FFO/share grew from $6.32 to $6.55.

It’s also worth noting that the reason Federal Realty’s interest expenses didn’t grow too much relative to the year-over-year increases seen in other REITs is due to its healthy credit profile. This benefit is directly tied to its high-quality property portfolio and tremendous operating track record.

Specifically, at the end of the year, 87% of Federal Realty’s total debt was at fixed rates, largely mitigating the impact of rate increases. Also, the company has no debt maturities remaining in 2024 and no material maturities until 2026. Thus, assuming the current interest rates don’t last for more than two to three years, Federal Realty should be able to stroll through a relatively challenging real estate environment quite comfortably.

For this reason, Wall Street believes the company will have no issue with Federal Realty growing its profits in the coming years. FFO/share is expected to gradually grow to $6.80 and $7.17 in FY 2024 and FY 2025, respectively.

Dividend Growth Appears Soft but Could Reaccelerate

At first glance, Federal Realty’s dividend growth prospects appear soft. The REIT has increased its dividend per share at a compound annual growth rate (CAGR) of just 3.7% over the past 10 years. Dividend increases have seen a gradual deceleration in recent years, with the most recent one last August being by just 0.9%. While this is surely a disappointing dividend growth pace that even underperforms inflation, there is a decent chance Federal Realty will reaccelerate the pace of dividend growth at some point soon.

I believe this to be the case since its payout ratio has improved materially in recent years. With FFO/share growth outpacing its dividend increases, Federal Realty has reduced its payout meaningfully. The payout ratio stood at 92%, 76%, 68%, and 64% in each year between 2020 and 2023, respectively. With FFO/share expected to keep growing at a decent pace, dividend increases are also likely to pick up soon.

In the meantime, the stock’s 4.4% dividend yield provides a sizable tangible return, even within the current interest rate landscape.

Is FRT Stock a Buy, According to Analysts?

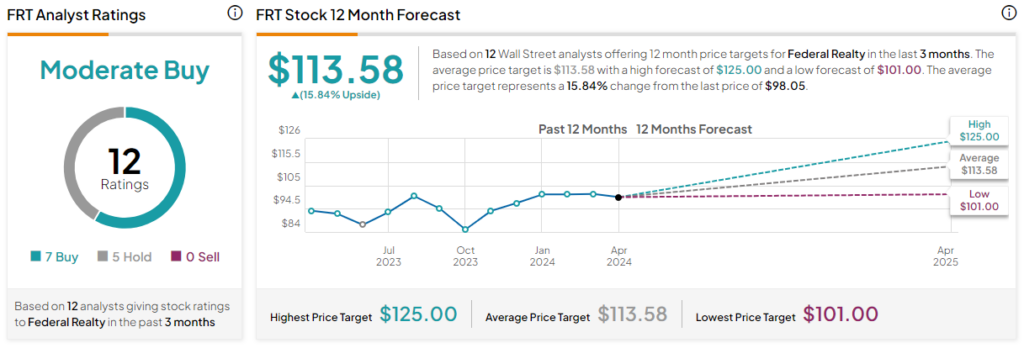

Checking Wall Street’s view on the stock, Federal Realty features a Moderate Buy consensus rating based on seven Buy and five Hold ratings assigned in the past three months. At $113.58, the average Federal Realty stock price target suggests 15.8% upside potential over the next 12 months.

Final Thoughts on FRT Stock

Summing up, I believe that Federal Realty presents a relatively compelling investment opportunity despite high interest rates pressuring the real estate sector. With its robust property portfolio and healthy balance sheet producing robust top- and bottom-line metrics, Federal Realty appears to be faring better than many other REITs. Combined with the possibility of stronger dividend growth prospects over time, supported by an improving payout ratio, Federal Realty stock forms an attractive investment case.